The human tragedy the COVID-19 pandemic has inflicted on the world is incalculable and continues to grow. Every human life is priceless and deserves the care needed to sustain it. COVID-19 is also impacting entire industries, causing them to randomly move in unpredictable ways, directly impacting IT and tech spending.

COVID-19’s impact on industries

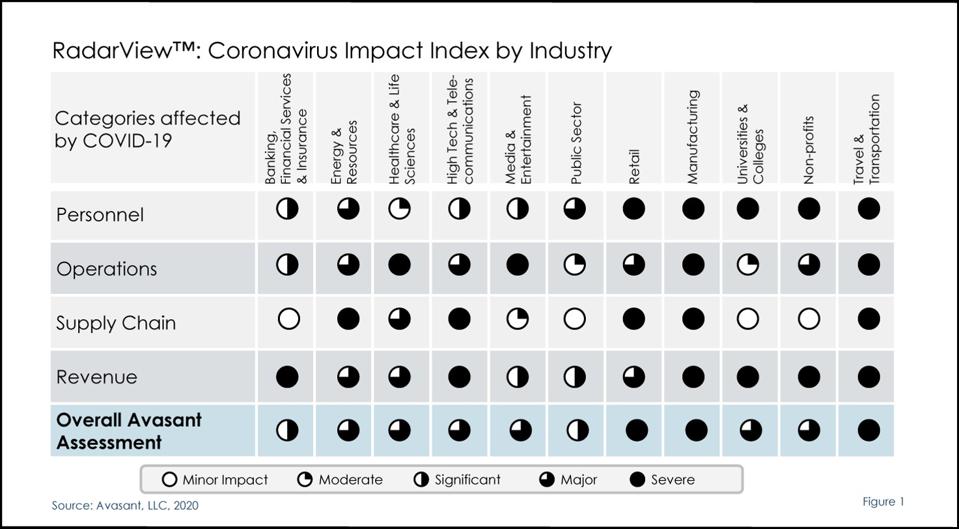

Computer Economics in collaboration with their parent company Avasant published their Coronavirus Impact Index by Industry that looks at how COVID-19 is affecting 11 major industry sectors in four dimensions: personnel, operations, supply chain, and revenue. Please see the Coronavirus Impact Index by Industry by Tom Dunlap, Dave Wagner, and Frank Scavo of Computer Economics for additional information and analysis. The resulting index is an overall rating of the impact of the pandemic on each industry and is shown below:

Computer Economics and Avasant predict major disruption to High Tech & Telecommunications based on the industry’s heavy reliance on Chinese supply chains, which were severely impacted by COVID-19.

Based on conversations with U.S.-based high tech manufacturers, I’ve learned that a few are struggling to make deliveries to leading department stores and discount chains due to parts shortages and allocations from their Chinese suppliers. North American electronics suppliers aren’t an option due to their prices being higher than their Chinese competitors. Leading department stores and discount chains openly encourage high tech device manufacturers to compete with each other on supplier availability and delivery date performance.

In contrast to the parts shortage and unpredictability of supply chains dragging down the industry, software is a growth catalyst. The study notes that Zoom, Slack, GoToMyPC, Zoho Remotely, Microsoft Office365, Atlassian, and others are already seeing increased demand as companies increase their remote-working capabilities.

COVID-19’s impact on IT spending

Further supporting the Coronavirus Impact Index by Industry analysis, Andrew Bartels, VP & Principal Analyst at Forrester, published his latest forecast of tech growth today in the post, The Odds of a Tech Market Decline In 2020 Have Just Gone Up To 50%.

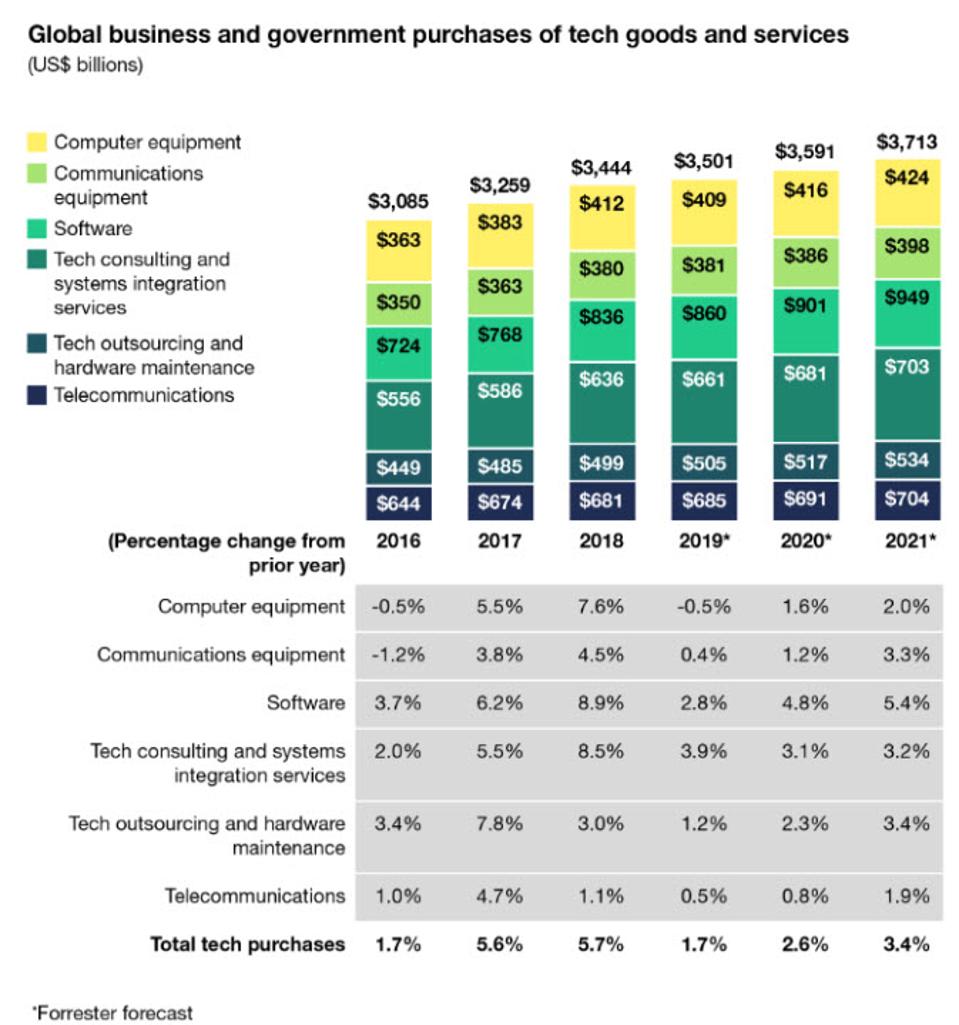

Mr. Bartels is referencing the market forecasts shown in the following forecast published last month, New Forrester Forecast Shows That Global Tech Market Growth Will Slip To 3% In 2020 And 2021 and shown below:

Key insights from Forrester’s latest IT spending forecast and predictions are shown below:

- Forrester is revising its tech forecast downward, predicting the US and global tech market growth slowing to around 2% in 2020. Bartels mentions that this assumes the US and other major economies have declined in the first half of 2020 but manage to recover in the second half

- If a full-fledged recession hits, there is a 50% probability that US and global tech markets will decline by 2% or more in 2020

- In either a second-half 2020 recovery or recession, Forrester predicts computer and communications equipment spending will be weakest, with potential declines of 5% to 10%

- Tech consulting and systems integration services spending will be flat in a temporary slowdown and could be down by up to 5% if firms cut back on new tech projects

- Software spending growth will slow to the 2% to 4% range in the best case and will post no growth in the worst case of a recession

- The only positive signs from the latest Forrester IT spending forecast is the continued growth in demand for cloud infrastructure services and potential increases in spending on specialised software. Forrester also predicts communications equipment, and telecom services for remote work and education as organisations encourage workers to work from home and schools move to online courses

Conclusion

Every industry is economically hurting already from the COVID-19 pandemic. Now is the time for enterprise software providers to go the extra mile for their customers across all industries and help them recover and grow again. Strengthening customers in their time of need by freely providing remote collaboration tools, secure endpoint solutions, cloud-based storage, and CRM systems is an investment in the community that every software company needs to make it through this pandemic too.

Photo by Micheile Henderson on Unsplash

Interested in hearing industry leaders discuss subjects like this and sharing their experiences and use-cases? Attend the Cyber Security & Cloud Expo World Series with upcoming events in Silicon Valley, London and Amsterdam to learn more.

Interested in hearing industry leaders discuss subjects like this and sharing their experiences and use-cases? Attend the Cyber Security & Cloud Expo World Series with upcoming events in Silicon Valley, London and Amsterdam to learn more.