Concerns about security, downtime and latency, budgets, and general unfamiliarity with cloud technologies continue to create hesitation for many organizations that truly need to be developing a cloud strategy. Hybrid cloud solutions are helping to elevate those concerns by enabling the combination or orchestration of two or more platforms, including on-premise infrastructure, private clouds and/or third-party, public cloud services. This gives organizations more comfort to begin their digital transformation without a complete overhaul of their existing infrastructure – serving as a sort of “missing link” for transition to cloud utilization.

Monthly Archives: October 2018

Cloudera and Hortonworks merge for $5.2 billion in consolidation of big data market

From competitors to friends; big data behemoths Cloudera and Hortonworks are to merge in a $5.2 billion (£3.97bn) deal.

Cloudera, which went for IPO last year, noted Hortonworks, which went public in 2014, as a competing open source player in its filing to the SEC. The companies are often compared in terms of Hadoop deployments – while the software has the potential to crunch huge amounts of data, it is by no means an out-of-the-box solution. Hence where companies such as Cloudera and Hortonworks come in.

Key considerations to the move included, naturally, value to shareholders, as well as planned financial benefits and product convergence. In particular, the two companies said the accelerated market development would fuel innovation in the Internet of Things, hybrid cloud, as well as machine learning and artificial intelligence.

There is a reasonable boardroom shuffle; Cloudera CEO Tom Reilly will be chief exec of the newly-formed company, while Hortonworks CEO Rob Bearden will join the board of directors. Scott Davidson, chief operating officer at Hortonworks, will become COO at the new company, with Hortonworks chief product officer Arun C. Murthy and Cloudera chief financial officer Jim Frankola doing likewise.

“Our businesses are highly complementary and strategic. By bringing together Hortonworks’ investments in end-to-end data management with Cloudera’s investments in data warehousing and machine learning, we will deliver the industry’s first enterprise data cloud from the edge to AI,” said Reilly in a statement. “This vision will enable our companies to advance our shared commitment to customer success in their pursuit of digital transformation.”

According to a recent study from IDC, revenues for big data and business analytics solutions will hit $260 billion by 2022, with banking, manufacturing and professional services among the industries making the largest investments in the technology.

As the two companies noted, increasing workloads and technological capabilities at the edge, as well as the potential of AI, means getting efficient data processing will be a huge opportunity for businesses going forward. Cloudera and Hortonworks have taken the decision that two heads are better than one in this scenario.

You can take a look at the investor presentation here.

Interested in hearing industry leaders discuss subjects like this and sharing their use-cases? Attend the co-located AI & Big Data Expo events with upcoming shows in Silicon Valley, London and Amsterdam to learn more. Co-located with the IoT Tech Expo, Blockchain Expo and Cyber Security & Cloud Expo so you can explore the future of enterprise technology in one place.

Interested in hearing industry leaders discuss subjects like this and sharing their use-cases? Attend the co-located AI & Big Data Expo events with upcoming shows in Silicon Valley, London and Amsterdam to learn more. Co-located with the IoT Tech Expo, Blockchain Expo and Cyber Security & Cloud Expo so you can explore the future of enterprise technology in one place.

A look beyond 2019: AI, blockchain and quantum – and what this means for the cloud behemoths

As technology changes, the roles the key actors play changes with it. The feted Institute of Engineering and Technology hosted analysts from CCS Insight, who gave wide-ranging predictions on the state of the enterprise technology ecosystem – with the biggest cloud players featuring heavily in future trends.

The yearly jamboree has taken on something of a life of its own, with press headlines regularly questioning some of the more outlandish claims the company has made – only for CCS to be more often than not proved right. CEO Shaun Collins, who insisted his opening speech was not just a 'greatest hits' package, went through the reel, including Three making a move for O2 – later ruled out by the European Commission – and Google acquiring Motorola.

This time around, for enterprise heads, there was plenty of focus on both the emerging technologies generating buzzword bingo cards and the largest companies with a strangehold on the ecosystem. These companies are defined by CCS as the 'agenda setters', with eight members in total; from the West, Alphabet, Apple, Facebook and Microsoft; from the East, Alibaba and Tencent; and in a category of its own, SoftBank, considering its continued spending spree on emerging players.

Martin Garner, senior vice president, spent the first half of his session grappling with the catch-all term 'digital transformation'. What does it actually mean? What results are coming from it? It would appear those pushing the term to its utmost don't really know themselves. Garner emailed Microsoft asking for a flavour on what benefits customers were getting. Microsoft's PR team responded a week later saying they had no numbers they could share.

With this in mind, Garner guesstimated. If 10% of companies were involved in digital transformation initiatives, then there would need to be a 10% efficiency gain to make an official dent – something measureable in the economy. The problem is, we're a little way off that.

Enter, stage left, three heroic figures; artificial intelligence, blockchain, and the Internet of Things. As this publication has variously noted, seeing these technologies outside of their silos will unlock various insights. This was therefore the first prediction CCS put out: AI, blockchain and IoT will become highly interdependent technologies by 2021. "The industry tends to talk about it all independently, but we believe this misses the bigger picture," said Geoff Blaber, VP research Americas.

AI will be the core to understanding insights from data and releasing its value, while blockchain will help establish trust and security. But there is another, more unsung hero. "Connectivity is the big piece here," said Blaber," that ensures you can move that data as intelligently and as seamlessly as possible."

Blockchain was a particularly interesting touchpoint. "There is ridiculous, ridiculous levels of hype around blockchain," said Blaber, "but that doesn't mean it doesn't have significant value." Take Walmart and mangoes as an example. Thanks to a China-based partnership announced last December, the retail giant has taken the process of getting all stakeholders aligned – from farm to factory to supplier – down from seven days to just over two seconds.

Cloud and blockchain will certainly combine – in terms of the hypervendors, that is. All major cloud service providers deploy blockchain commercially by the end of 2019, the analyst firm predicted. It's interesting to note here how reticent Amazon Web Services (AWS) was to initially make its move. At last November’s re:Invent many announcements were made – but blockchain was not one of them. The company would only say it was ‘intrigued’ by what its customers would do there. Six months after, AWS launched blockchain network templates.

Lots of services are being punted out to test the water – but the next 12 months, CCS argued, will see major releases. "Blockchain is essentially relevant to any industry or any transaction that needs to be securely documented," added Blaber.

That was not the most eye-catching potential change however – although it must be noted the upcoming remains only potential. Nick McQuire, VP enterprise at CCS Insight, had the arguably unenviable task of explaining quantum computing; as he put it, one of the most difficult things that humans have ever attempted. Put simply, quantum is a significant improvement on classical computing. It is not so much computing in 0s and 1s, but more 'stateless’, sub-atomic particles existing – albeit very briefly and inconsistently in this context today – in more than one state.

Here's the double-take. Classical computers would take one billion years to break encryptions such as RSA. According to Microsoft, with a product they are looking to put together in 2019, it could be broken in 100 seconds.

"It's no longer in the exclusive realm of crap science fiction films," joked McQuire as a slide of Quantum Leap came up – which he admitted seemed a little harsh on the film. "Quantum is going to being quite a number of significant security concerns into the security ecosystem overall – encryption is going to be strengthened to defend against attacks from quantum computers.

"Those that are interested in cloud are going to differentiate themselves around quantum," McQuire added. "The size of customer workloads is doubling every year as more and more organisatons go to cloud – it's a tremendous strain on the resource that is there, particularly silicon. We think quantum over time is going to solve a lot of this strain."

When it came to artificial intelligence, CCS argued the big cloud vendors would again be a part of the action. By 2020, the company predicted, cloud service providers would expand from general purpose AI to business-specific applications.

Putting products together around voice, chatbots, video, and so forth, McQuire argued, is all well and good – but what do industries really want? Yes, the call centre is where we've seen things happen, but what about predictive maintenance in manufacturing, fraud detection in finance, and demand forecasting and dynamic pricing in retail? The agenda setters will put together pre-built products to address these challenges, he added.

Underpinning the vast majority of this is the concept of trust. The overriding theme of the sessions was around steering the data-driven economy, but of course not all data is created equal as Facebook found out after the Cambridge Analytica scandal – a topic oft-referenced by the analysts.

This formed the basis of another prediction: trust would be the most important source of competition among cloud service providers in 2019. The example given was around Walmart's beef with AWS, covered in chapter and verse by this publication. Earlier this year, to the surprise of not many, the retail giant went all-in with Microsoft.

"The likes of Amazon, Alibaba, Facebook, Google and Microsoft recognise the importance of winning customers' trust to set them apart from rivals, prompting a focus on greater transparency, compliance efforts and above all investment in security," the company wrote.

So back to the agenda setters. This is the agenda they should be setting, but may they be usurped? McQuire sounded a cautionary note with his closing analysis – and it is to the East we turn.

China's relationship with Tencent in terms of its citizen services has caused eyebrows to be raised – not least with the bombshell story around 'spy chips' being inserted into Chinese business computers comprehensively dismissed by Apple and Amazon. But the link between technology and government is one to look at. "What we're starting to see from those geographies is very significant long-term planning and billions of investment in the very technologies the agenda setters are competing on," said McQuire.

"In 12 to 18 months, it may not just be the companies themselves disruptive to this community, but governments themselves. It may just mean there is an arms race emerging at a national level."

Do you agree with these CCS Insight predictions? Let us know in the comments.

Interested in hearing industry leaders discuss subjects like this and sharing their use-cases? Attend the co-located IoT Tech Expo, Blockchain Expo, AI & Big Data Expo and Cyber Security & Cloud Expo World Series with upcoming events in Silicon Valley, London and Amsterdam and explore the future of enterprise technology.

Interested in hearing industry leaders discuss subjects like this and sharing their use-cases? Attend the co-located IoT Tech Expo, Blockchain Expo, AI & Big Data Expo and Cyber Security & Cloud Expo World Series with upcoming events in Silicon Valley, London and Amsterdam and explore the future of enterprise technology.

How multi-cloud business models will shape the future

Architects of the future build optimal businesses. In an automated, security conscious world, organisations must rethink their cloud strategies, embed security into application development, and embrace new work practices to stay relevant. Now is the time to plan your journey.

Shaping the future

Experts agree that, over the next five years, the multi-cloud world will be the playground for innovation, allowing organisations to launch new services and enhance advanced technologies.

A recent Foresight Factory report entitled, The Future of the Multi-Cloud (FOMC) sponsored by F5, reveals how the pace of digital transformation is already dramatically disrupting existing business models. It also details how organisations are forced to reassess their skills, existing infrastructure, and tools to manage the multi-cloud more effectively. The EMEA-focused study captures insightful commentary from eminent cloud experts on how businesses will need to hasten their multi-cloud readiness in order to meet consumer demand for fast, seamless services.

Over the next five years, experts forecast that EMEA cloud-based business models will require substantial changes, if not a complete re-architecture of strategic procedures, policies, systems, and tools. While moving to the cloud can present some security challenges, it also opens new opportunities to safeguard operations while simultaneously scaling and innovating in real-time.

IT departments are under growing pressure to run a well-established security infrastructure and scale to meet customer demands. Moving apps to public and private cloud environments will enable enterprises to be dynamic with data management while also implementing app-centric services with strong security solutions to mitigate against cybercrime. Yet, achieving a consistent security posture, including user authentication and policy controls, is a complex task when amplified across multi-cloud platforms.

“The multi-cloud ramp up is one of the ultimate wake up calls in internal IT,” says Eric Marks, VP of cloud consulting at CloudSpectator. “I think that one of the biggest transformative changes that it brings to an enterprise is the realisation of what a high performing IT organisation is and compares to what they have. Most of them are finding their IT organisations are sadly underperforming.”

Automation changes the game

The attack surface is broadening all the time. Increasing gateway services and application programming interfaces, as well as developments in fields like the Internet of Things, are shaking the status quo to its core. The threat landscape is more sophisticated than ever due to volumetric attacks, malicious bots, and other tools targeting apps and sensitive data. Many traditional practices are no longer effective because they are too labour intensive and time inefficient to protect what really matters. This is where automation comes in to streamline and standardise IT processes, as well as remove human error. It also helps IT staff focus on other priorities, such as analytics and problem solving.

Against this backdrop, experts recognise that is not enough to just move applications to the cloud. It is imperative to address the business objectives in line with market needs and apply integrated tools sets that provide automated workflows, greater visibility, and analytical capabilities. It is also critical to establish new working methodologies for better collaboration and efficiency.

Cloud skills of the future will also look different to those of today. To stay relevant, NetOps teams must embrace automation capabilities to reduce slow, manual traditional processes, whereas DevOps teams must embed security disciplines into the production phase. Siloed working is a thing of the past. Together, the path of optimisation and orchestration will lead to a more prosperous outcome and ensure customer-centricity and data compliance.

“Automation is key, governance is key, third party security systems and identity access management are key. This is going to drive a lot of spending over the next five years,” predicts David Linthicum, chief cloud strategy officer at Deloitte Consulting, and other prominent FOMC contributors.

In fact, adopting a multi-cloud route does not have to mean compromising security. With advanced security solutions, businesses can safely move their applications to any cloud model that works best for their strategy without geographic or infrastructural constraints. Consumer demands and industry competitiveness continue to make the cloud an essential option. The right deployment strategy makes it a viable and safe one.

Clearly, skills need to swiftly evolve. Cloud architects must be empowered with comprehensive solutions to deliver panoramic visibility and analytics, highly intelligent and contextual awareness, and sophisticated policy controls.

Deal with disruption

With the future in mind, expect the unexpected. New serverless architecture will enable enterprises to cut time-to-market and enable simplification of processes. Intelligent automation and machine learning are already easing the path towards optimal multi-cloud deployments.

EMEA organisations need to be prepared to undergo significant change and boldly face disruption head on. If you are not turning to the multi-cloud for flexibility, innovation, and being data compliant, then your customers will quickly shape your future by turning to some else they can trust.

How converged systems are enabling IT transformation initiatives

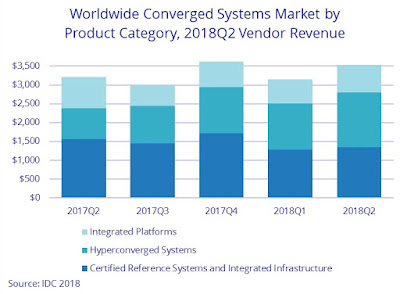

Some IT organisations prefer infrastructure solutions that offer simplified cloud deployment models for their digital transformation projects. According to the latest market study by International Data Corporation (IDC), worldwide converged systems market revenue increased 9.9 percent year-over-year to $3.5 billion during the second quarter of 2018 (2Q18).

"Data centre infrastructure convergence remains an important investment driver for companies around the world," said Sebastian Lagana, research manager at IDC. "HCI solutions helped to drive second-quarter market expansion thanks, in part, to their ability to reduce infrastructure complexity, promote consolidation, and allow IT teams to support an organisation's business objectives."

Converged systems market development

IDC's converged systems market view offers three segments: 1) certified reference systems & integrated infrastructure, 2) integrated platforms, and 3) hyperconverged systems.

The certified reference systems and integrated infrastructure market generated $1.3 billion in revenue during the second quarter, which was a year-over-year decline of 13.9 percent and represented 38.1 percent of total converged systems revenue.

Integrated platforms sales declined 12.5 percent year over year during the second quarter, generating revenues of $729.4 million. This amounted to 20.7 percent of the total converged systems market revenue.

Revenue from hyperconverged systems sales grew 78.1 percent year-over-year during the second quarter of 2018, generating $1.5 billion worth of sales. This amounted to 41.2 percent of the total converged systems market.

IDC offers two ways to rank technology suppliers within the hyperconverged systems market: by the brand of the hyperconverged solution or by the owner of the software providing the core hyperconverged capabilities.

Converged systems market segmentation

As it relates to the branded view of the hyperconverged systems market, Dell Inc. was the largest supplier with $418.7 million in revenue and a 28.8 percent share. Nutanix generated $275.3 million in branded revenue with the second largest share of 18.9 percent.

Cisco and HPE were statistically tied for the quarter, with $77.7 million and $72.0 million in revenue, or 5.3 percent and 4.9 percent in market share, respectively.

From the software ownership view of the market, systems running Nutanix's hyperconverged software represented $497.7 million in total second-quarter vendor revenue or 34.2 percent of the total market.

Systems running VMware's hyperconverged software represented $495.8 million in second quarter vendor revenue or 34.1 percent of the total market. Both amounts represent all software and hardware revenue, regardless of how it was ultimately branded.

Interested in hearing industry leaders discuss subjects like this and sharing their experiences and use-cases? Attend the Cyber Security & Cloud Expo World Series with upcoming events in Silicon Valley, London and Amsterdam to learn more.

Interested in hearing industry leaders discuss subjects like this and sharing their experiences and use-cases? Attend the Cyber Security & Cloud Expo World Series with upcoming events in Silicon Valley, London and Amsterdam to learn more.

Mac Computers in Your Organization? Get a Consistent User Experience for Admins.

Most organizations are centered around Windows clients, which then determines their IT team’s focus and facilities. This is why relevant tools such as Microsoft SCCM are in use for managing the multitude of endpoint systems. Things grow more complicated when Mac® clients start showing up and need to be integrated into the organization’s environment in […]

The post Mac Computers in Your Organization? Get a Consistent User Experience for Admins. appeared first on Parallels Blog.

Registration Opens for @ConsenSysAndrew #Blockchain Session at @EXPOFinTech NY | #FinTech #Bitcoin #Ethereum

Andrew Keys is Co-Founder of ConsenSys Enterprise. He comes to ConsenSys Enterprise with capital markets, technology and entrepreneurial experience. Previously, he worked for UBS investment bank in equities analysis. Later, he was responsible for the creation and distribution of life settlement products to hedge funds and investment banks. After, he co-founded a revenue cycle management company where he learned about Bitcoin and eventually Ethereum.

Difference Between Big Data and Internet of Things | @ExpoDX @Schmarzo #BigData #IoT #IIoT #DigitalTransformation

A recent argument with folks whose intelligence I hold in high regard (like Tom, Brandon, Wei, Anil, etc.) got me thinking about the following question: What does it mean, as a vendor, to say that you support the Internet of Things (IOT) from an analytics perspective? I think the heart of that question really boils down to this: What are the differences between big data (which is analyzing large amounts of mostly human-generated data to support longer-duration use cases such as predictive maintenance, capacity planning, customer 360 and revenue protection) and IOT (which is aggregating and compressing massive amounts of low latency / low duration / high volume machine-generated data coming from a wide variety of sensors to support real-time use cases such as operational optimization, real-time ad bidding, fraud detection, and security breach detection)?

Cloudera and Hortonworks announce $5.2bn merger

Cloudera and Hortonworks, two of the largest providers of open source enterprise Hadoop products, have announced a merger of equals deal that’s said to place their joint value at $5.2 billion.

The deal is an all-stock merger, with Cloudera stockholders taking ownership of approximately 60% of the combined company, with Hortonworks stockholders taking the remaining 40%. The combined companies will boast more than 2,500 customers, around $720 million in revenue, and over $500 million in debt-free cash.

The Big Data companies, once heavy rivals, have built their businesses on providing simpler, packaged IT services for companies wanting to exploit the data processing power of the Hadoop platform but are unable to build systems from scratch.

Where Hortonworks has largely relied on charging for support services as a purely open source provider, Cloudera based much of its business on subscription services. The deal will likely see many Hortonworks customers transition over to a subscription fee, providing an early spike in revenue for the joint company.

The deal places the companies in a far better position to take on newer cloud solutions by providing a platform that covers multiple cloud types, as well as on-premise and Edge. It also gives the two companies a far better chance at maintaining profitability in the heavily crowded Big Data space.

“This compelling merger will create value for our respective stockholders and allow customers, partners, employees and the open source community to benefit from the enhanced offerings, larger scale and improved cost competitiveness inherent in this combination,” said Rob Bearden, chief executive officer of Hortonworks.

“Together, we are well positioned to continue growing and competing in the streaming and IoT, data management, data warehousing, machine learning/AI and hybrid cloud markets. Importantly, we will be able to offer a broader set of offerings that will enable our customers to capitalize on the value of their data.”

Cloudera CEO Tom Reilly will serve as CEO of the combined firm, while Hortonworks’ COO and CFO Scott Davidson will stay on as COO.

Current Hortonworks CEO Rob Bearden will join the board of directors, with current Cloudera board member Marty Cole moving up to chairman.

Shares in the firms spiked post the news, with Cloudera stock surging 26% in after-hours trading, and Hortonworks rising by 27%.

Wi-Fi Alliance replaces ‘802.11’ naming scheme with version numbers

Wi-Fi Alliance has simplified the names for Wi-Fi standards by dropping its complex code scheme, such as ‘802.11’.

Instead, the alliance has introduced single digit classifications, starting with ‘Wi-Fi 6’ which is the new designation for products and networks that support Wi-Fi based on 802.11ax technology.

The alliance hopes that Wi-Fi 6 will provide users with an easy-to-understand designation for both the Wi-Fi technology supported by their device and used in a connection the device makes with Wi-Fi networks.

“For nearly two decades, Wi-Fi users have had to sort through technical naming conventions to determine if their devices support the latest Wi-Fi,” said Edgar Figueroa, president and CEO of Wi-Fi Alliance.

“Wi-Fi Alliance is excited to introduce Wi-Fi 6 and present a new naming scheme to help industry and Wi-Fi users easily understand the Wi-Fi generation supported by their device or connection.”

The new naming system will identify Wi-Fi generations in a numerical sequence that corresponds to major advancements in Wi-Fi. The generation names can be used by product vendors to identify the latest Wi-Fi technology a device supports, by operating system vendors to identify the Wi-Fi connection between a device and a network and by service providers to identify capabilities of a Wi-Fi network to their customers.

Wi-Fi Alliance said this new terminology may also be used to differentiate previous generations, such as 802.11n or 802.11ac. The numerical sequence includes Wi-Fi 6 and also Wi-Fi 5 to identify devices that support 802.11ac technology and Wi-Fi 4 to identify devices that support 802.11n technology.

The change has already been welcomed by the tech industry, including Lissa Hollinger, VP of marketing for Hewlett Packard’s Aruba: “We applaud this effort by Wi-Fi Alliance to simplify the terminology used to differentiate between the different generations of technologies as it will help users more quickly and easily discern the technology their particular device or network supports.”