Not very long ago, in my IT consulting career, I used to be responsible for the launch of mission-critical applications that help enterprises leap into the cutting edge of the digital business revolution. There were a lot of hard skills required for leading such a mission that involved getting the system architecture and software design right early, mentoring and managing the engineering resources, and tracking the progress to the satisfaction of the business analysts who put together the requirements and the stakeholders who funded the projects. Those skills, while hard, were largely deterministic and manageable vs another set of skills required to ensure that the built applications come alive in production environments, and run reliably and securely thereafter. This other set of skills often pit the application developers against the infrastructure administrators and InfoSec professionals.

Monthly Archives: September 2017

Is Wall Street Moving to Cloud?

The benefits of cloud are there for everyone to see. Right from improving productivity to reducing costs, cloud has been providing a ton of advantages to companies. With so many benefits, it’s only right that companies want to make the most of them. Wall Street is no exception to this rule.

Many large financial institutions that are a part of Wall Street have started thinking of using the cloud to get a competitive advantage in a fairly tough market. They want to make the most of cloud to drive innovation and to stand out as a preferred institution among customers.

Some companies like CapitalOne have been using cloud services for some time now, while others like JP Morgan and ANZ Bank have announced that they will be moving to a cloud platform fairly soon. Other smaller companies are likely to follow suit too.

Reliable sources confirm that these financial institutions are considering the top three players, namely, Amazon Web Services, Google and Microsoft, for this shift to the cloud. Long years of effort in laying an extensive and strong infrastructure is touted to be the reason to consider only these three providers.

All the three companies have an expansive network and have all the necessary tools and services in place to cater to Wall Street. Using this infrastructure, JP Morgan and other financial institutions are improve their technical capabilities and in the process, drive up efficiency and bring down costs.

In many ways, it’s a surprise that the larger financial institutions haven’t turned to the cloud yet. Small organizations like credit unions moved their operations to the cloud a few years ago, but the larger organizations have started this move just now.

Why?

Security was one of the major concerns that held back these companies from making a shift because even the smallest of breaches can prove to be an expensive affair. But now, cloud security has improved and there’s more confidence in the cloud than ever before.

Also, the fact that hackers were able to breach into the so-called “secure” systems of these companies led them to reconsider their choices, and soon they found that cloud is a tenable option. They not only get other benefits such as improved productivity and lesser costs, but also the security is at least on par with what they have, if not better.

To top it, regulators are also going easy on the idea of moving data to the cloud because they also understand that this is the future and it’s only right for banks to make this transition too.

This is why asset managers, insurance companies and large banks are running different tests, talking to vendors and even modifying their existing policies to ensure that their transition to the cloud is smooth and easy.

Overall, wall street is moving to the cloud soon and it won’t be long before customers can enjoy more services while banks stand to gain financially and from an operational standpoint through this transition.

The post Is Wall Street Moving to Cloud? appeared first on Cloud News Daily.

British Medical Journal expands to China with help of Alibaba Cloud and Datapipe

More and more companies are trying to get a foothold in China as part of their international expansion – and the British Medical Journal (BMJ) is one, having worked with managed cloud services provider Datapipe to enter the Chinese market using Alibaba Cloud.

Datapipe has been working with Alibaba as a global managed service provider of its cloud arm since 2016, and was also named the leading Asia Pacific managed cloud company by Frost & Sullivan. For BMJ, the concept was straightforward, needing a partner on the ground in China with knowledge of the market to take advantage of Alibaba’s local public cloud infrastructure.

“We have now fully realised the strategy that we first mapped out two years ago, when we started our cloud journey,” said Alex Hooper, BMJ head of operations. “In the first year, we were able to fully virtualise our infrastructure using Datapipe’s private cloud, and in the process, move to a new, agile way of working. In this second year, we have embraced public cloud and taken our services over to China.”

This is not the BMJ’s first dalliance with Datapipe; the company had previously used the managed service provider to help refresh its legacy technology stack, moving from one release a month on average to up to four times a day, with Sharon Cooper, chief digital officer, describing the working relationships between dev, ops, test and business needs as ‘unrecognisable’ from before.

As regular readers of this publication will be aware, Alibaba is making concerted cloud strides. Last month, with the publication of its financial results, CEO Daniel Zhang said its cloud business “continues to enjoy high growth at scale” and the recent passing of the one million customer mark is “merely a starting point.”

Writing for this publication last month, Alibaba Cloud noted the importance of not falling into various traps when moving into the Chinese market. “China is a highly competitive market, and consumers expect a smooth and secure online experience,” the company wrote. “The flexibility, scalability and security offered by the cloud provides an optimal solution to boost your website in China’s competitive online space.”

You can find out more about Datapipe’s integration with Alibaba Cloud here.

Cloud research roundup: Big numbers from the big four

Recent research reports from around the industry saw a range of interesting cloud market results and predictions emerge, underlining the real world momentum behind the cloud story. The big four – AWS, Microsoft, IBM and Google – dominate the market and their fortunes drive much of the analysis. But what’s also clear is that there’s still plenty of room for even more growth both domestically and internationally.

Public cloud – a thriving oligopoly

In the cloud infrastructure services (public cloud) market, the big four continue to prosper, according to market research firm, Synergy.

In a sector worth $11bn a quarter globally, AWS remains well out in front of its rivals, commanding a bigger market share than Microsoft, IBM and Google combined.

According to Synergy, market share among these four was largely unchanged in the last four quarters, with the exception of Microsoft who saw an increase of 3%. And despite being a dynamic industry, it’s a similar trend to two years ago when AWS held a similarly dominant position.

Neither Google or Microsoft break out the figures for their respective public cloud offerings, but Amazon does specify numbers for AWS. In their 2017 Q2 figures recently released, AWS posted a $916m profit in the three months ending in June, against revenues of $4.1bn and a 58% sales growth.

Let’s give this some context – Alphabet’s entire Q1 2017 revenue (of which Google Cloud is a non-specific part) was $24.75bn. So, while public cloud is big money, there’s almost certainly plenty more to be made, with Synergy expecting overall growth rates of over 40% per year going forward.

A booming global market

Global spending on public cloud services will reach $226bn by 2021, according to IDC.

These are huge numbers, but to put them in perspective, Apple, the most profitable company in the world, brought in revenues of $233bn, according to Forbes 2016 rankings. Microsoft, a massive worldwide success story and employer of nearly 100,000 people, generated $85.3bn in the same year, a figure just ahead of the entire revenue of the worldwide information security market.

The US will account for 60% of worldwide public cloud revenues ($163bn in 2021). The industry’s leading the charge are professional services (sector growing at 21.5% pa), media (21%), retail and telecoms (both 20.9% annual growth).

IDC say that much of the spending growth in these industries is coming from “new projects and initiatives from functional areas like customer service and sales”.

But the UK lags behind on cloud adoption… maybe

Research by Fuze suggests only 10% of UK businesses have successfully managed to move their entire organisation to the cloud. That compares to 45% of US organisations, who have completed their cloud migration.

On the one hand, this perspective assumes that an ‘all in’ cloud strategy is the only desirable end game. But earlier in the year, the Cloud Industry Forum found that the overall cloud adoption rate in the UK stood at 88%, but the vast majority of companies would follow a hybrid strategy for some time to come.

Allure of cloud causes skill shortages in ‘traditional’ IT roles

The momentum behind the cloud market also appears to be hovering up talent and skills from more traditional on-premises roles, according to 451 Research. More than 65% of organisations in the survey found recruiting for roles across traditional servers and converged infrastructure to be “increasingly difficult”.

451 expect the rise of cloud migration to further diminish the pool of people available for roles dedicated to server administration. They report that, “69.7% of respondents said that current candidates lack skills and experience [for on-premises roles]; plus a lack of candidates by region and high salaries point to a shrinking set of available talent.”

All of this research confirms what we already know: the cloud market is gargantuan and the potential for expansion is constantly growing. As organisations continually look to adopt increase the rate of cloud adoption, the vendor choices are small, but as everyone will tell you the rewards can be endless.

The Future of Automation | @DevOpsSummit #AI #ML #DX #DevOps #DigitalTransformation

We’ve all read the dystopian fiction, watched those apocalyptic movies and heard a myriad of prophetic warnings heralding our obsolescence. Surely now we’re just a couple of years from flipping the switch on a Skynet of our own making and condemning mankind to the annals of history.

Actually, we’re not entirely sure what the future holds, but it’s probably not fire and brimstone. For detractors and naysayers of technology, could there be a more fitting image than Terminator 2’s opening shot? A hulking, skeletal, humanoid machine crushing a human skull beneath its foot. Listening to ‘techno-skeptics’ can sure make it feel as though that’s the end which inevitably awaits us. If we continue down our current path of imbuing machines with increasing levels of autonomy, learning abilities and artificial intelligence, eventually we’ll inadvertently construct our own obsolescence – if not destruction! We must be careful, unless we want to find ourselves subjugated by a machine army…

Tara Seppa, Microsoft: How to Leverage Digital Disruption

Finally Getting the Most out of the Java Thread Pool | @CloudExpo #JVM #Java #Cloud

First, let’s outline a frame of reference for multithreading and why we may need to use a thread pool.

A thread is an execution context that can run a set of instructions within a process – aka a running program. Multithreaded programming refers to using threads to execute multiple tasks concurrently. Of course, this paradigm is well supported on the JVM.

Although this brings several advantages, primarily regarding the performance of a program, multithreaded programming can also have disadvantages – such as increased complexity of the code, concurrency issues, unexpected results and adding the overhead of thread creation.

In this article, we’re going to take a closer look at how the latter issue can be mitigated by using thread pools in Java.

Huawei’s Ambitious Plans for its Cloud Future

Demand for cloud services is increasing and the overall cloud market is growing at an astronomical rate. Almost every company in the cloud business wants to make the most of this growth, and Huawei is no exception.

It has decided to build a global cloud network on its own public cloud. Well, if that sounds confusing, it means, the cloud data center infrastructure will be owned, managed and branded by Huawei’s public cloud partners, but it is built on Huawei’s network. In many ways, we can imagine this network to be like a Hydra creature with many heads, spreading across different regions in the world.

Essentially, it is creating the infrastructure that includes itself and its partners, so that its customer base and network is spread all over the world. With such a plan in place, Huawei wants to be one of the top five public cloud providers in the world. According to the CEO, it believes Alibaba, Microsoft, Google and Amazon Web Services to be the other four public cloud providers against which it will be competing in the future.

This is a strategic move for many reasons. Firstly, the top four companies, according to Huawei, have already established their infrastructure, so it will require massive investments to compete with them. By partnering with other companies, it may be much easier for Huawei to penetrate into different markets.

Secondly, managing the entire infrastructure can be mind-boggling to say the least. The cost and resources involved will be enormous, so by leasing out its infrastructure, Huawei can have a more workable model that will also be load-friendly.

Lastly, it can avoid vendor lock-ins as all its partners don’t necessarily have to use this network. They can partner with Microsoft, Google, Alibaba or AWS for other operations too. In fact, Huawei offers hybrid solutions that make it easy for applications and customers to integrate with other third-party cloud platforms that include the platforms of its competitors as well.

This idea and its implementation has been progressing at a rapid pace. This unit of Huawei was first formed in March 2017 and since then, the company has seen a 238 percent increase in its customer base. This goes to show that many of its customers are looking forward to this public cloud product from Huawei.

So far, it has also released 40 new cloud services out of the total 85 cloud services it has released so far. This includes a data warehouse, DDoS protection and content delivery network that are having a big impact on its clients’ operations.

Many notable companies such as Volkswagen, Mercedes-Benz, Industrial bank of China and Philips are using Huawei’s products. It has also partnered with cloud service providers and telecom companies like Deutsche Telecom, Telefonica and Orange to further its plans.

Overall, it seems ambitious, but it also looks like Huawei has a firm plan in place to further its ambitions. The next few months can give us a better idea of the progress of this product and its acceptance among the global cloud clients.

The post Huawei’s Ambitious Plans for its Cloud Future appeared first on Cloud News Daily.

How digital evolution is defined by trusted relationships

Billions of people around the world use the internet to share ideas and trade with one another. With worldwide internet penetration at nearly 50 percent, the global digital economy has become a space of immense opportunity.

It’s clear that business transactions are becoming heavily reliant on us being connected onlne. Digital flows are now responsible for more GDP growth globally than trade in traditional offline goods and services. Digital transformation is now driving globalization.

As such, achieving a competitive advantage in the global digital arena has become a key priority for governments and businesses who strive for inclusion and relevance. It is also clear that trust has a critical role to play when countries look to improve their eCommerce adoption.

It’s in this context that The Fletcher School at Tufts University, in partnership with MasterCard, present findings from the 2017 edition of the ‘Digital Evolution Index’ (DEI 17).

Exploring national digital trust development

The DEI 17 includes analysis of each country’s DEI score and digital momentum – the rate at which countries have been developing their digital economies. To investors and businesses, momentum is indicative of market attractiveness and potential; to policymakers, it is a proxy for national competitiveness.

The DEI 17 reveals how a country measures up and also how it might take inspiration from techniques and initiatives that have proved successful elsewhere. This is essential knowledge in the changing digital landscape, and also for governments and policymakers overseeing digital transformation.

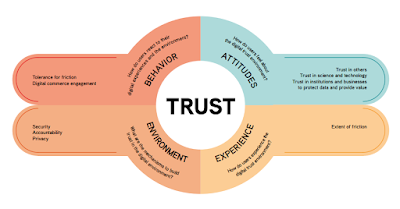

DEI 17 incorporates a framework for Digital Trust that includes:

- Trustworthiness of the digital environment and the users experience.

- Attitudes towards key institutions and commercial organizations.

- Citizen’s behavior when they interact with the digital world.

According to the global study findings, digital trust is rooted in relationships. The guarantors of digital trust form one axis: the institutions, businesses, individuals and governments that are responsible for creating and fostering a trustworthy digital environment.

The DEI 17 reveals the identities of the digital elites operating at this level. As a group, they are split in two. First, there are the international trade hubs of Hong Kong, Singapore and the UAE. And second, there are the nation states of the UK, Estonia, Israel and New Zealand.

These four countries are powering ahead of their rivals thanks to a complex formula of IT and network infrastructure, incubating start-ups, a cultural commitment to innovation, and government support.

“The top five scoring countries in the DEI 17 – Norway, Sweden, Switzerland, Denmark and Finland – are all ‘Stall Out’ countries, reflecting the challenges of sustaining fast upward momentum,” says Dr Bhaskar Chakravorti, senior associate dean of International Business and Finance at The Fletcher School at Tufts University.

One important indicator of a country’s digital potential is its uptake of mobile internet via tablets and smartphones. Countries that reached this stage through iterations of services originally aimed at traditional desktop computing. Others, however, have taken a more direct route, with a singular focus on internet access via mobile devices.

Outlook for digital trust advancements

“The U.S. and UK markets were introduced to the internet through desktops and laptops, but the 1.5 billion new internet users added in the past five years had their first brush with the internet on a mobile device,” said Dr Chakravorti.

Trust is becoming increasingly important to online transactions. But this isn’t universal. The DEI 17 study found major differences in the level of digital trust in different countries. In those nations undergoing rapid advances in digital tech – such as China, Malaysia, Bolivia, Kenya and Russia – individuals are more tolerant of slow and unreliable online technology.

By the time the next DEI comes around, we will know just how well they fared, as well as how insights gleaned from the DE1 2017 helped the developing nations to navigate a path forward.

[slides] Analytics and #FinTech | @CloudExpo #AI #ML #DL #DX #API #DigitalTransformation

Historically, some banking activities such as trading have been relying heavily on analytics and cutting edge algorithmic tools. The coming of age of powerful data analytics solutions combined with the development of intelligent algorithms have created new opportunities for financial institutions. In his session at 20th Cloud Expo, Sebastien Meunier, Head of Digital for North America at Chappuis Halder & Co., discussed how these tools can be leveraged to develop a lasting competitive advantage in priority areas: customer analytics, financial crime prevention, regulatory compliance and risk management.